exclamationOpen Enrollment Is Over!

Open Enrollment began on Wed., Oct. 15 and ended at 11:59 PM on Fri., Oct. 31, 2025! Generally, you cannot make changes to your benefits after Open Enrollment. The IRS allows employees covered by UA’s Section 125 cafeteria plan to pay for benefits on a pre-tax salary reduction basis. For UA to keep its tax-favored status, elections must be made annually on a prospective basis and remain irrevocable during the plan year. If you missed your once-a-year opportunity, then you will have to wait until next Open Enrollment unless you experience a qualifying life event (QLE). Exceptions will not be granted due to the risk of jeopardizing UA’s tax-favored status for all employee benefits.

Important Reminders

The University of Alabama strives to create a nationally competitive, customizable benefits package to attract and support our employees as the state’s flagship research institution, while ensuring that decisions align with overall financial capacity and comply with federal regulations.

Large employer group health plans, including UA, continue to face mounting financial pressure, with recent industry surveys indicating the total health benefit cost per employee is expected to rise 9% on average in 2026 — the highest increase in 15 years. To remain competitive in the market, stay in line with national benchmarks and keep overall benefit costs down as much as possible, UA will implement a premium increase and plan design changes for both medical plans next year. Employees are strongly encouraged to review these changes in advance to make the best decisions that fit your needs.

Representatives from the Benefits Office will be available at campus-wide information sessions and pop-up enrollment events to answer your questions and assist with enrollment decisions.

Employees will continue to experience a simplified annual enrollment process this year. Here are three key points to keep in mind as you prepare to make decisions:

ACTION REQUIRED

NO ACTION REQUIRED

REVIEW BENEFICIARIES

1. ACTION IS REQUIRED if you want to participate in the following tax-favored accounts.

All three accounts have new contribution limits for the upcoming year as outlined below. The IRS announced new contribution limits for 2026 on Thursday, Oct. 9. Read the news release.

exclamationTax-Favored Accounts Will Not Rollover

Your current HCFSA, DCFSA or HSA election is associated with the 2025 tax year and will not roll over, so you must elect a NEW annual contribution amount to continue payroll deductions as of Jan. 1, 2026. If you fail to elect a new contribution for your HCFSA or DCFSA, then your current account with Inspira Financial will close on Dec. 31, 2025 and you must wait until the next open enrollment period to participate unless you experience a qualifying life event.

HCFSA

Healthcare Flexible Spending$3,400 per employee, regardless of tax filing status. Dually-employed spouses may each contribute $3,400 for a combined $6,800 per household.

DCFSA*

Dependent Care Flexible Spending$7,500 for a single individual and married filing jointly; or $3,750 each if married filing separately. This is the first permanent limit increase since 1986; see disclaimer.

HSA

Health Savings Account$4,400 for an employee with single HDHP coverage; or $8,750 for family HDHP coverage. UA’s employer seed money will be included in this annual limit.

*Disclaimer for Dependent Care Flexible Spending Accounts:

“IRS regulations require that DCFSAs not discriminate in favor of certain employees who are considered “highly compensated” by the IRS, defined as employees with compensation in excess of $160,000 for the 2025 tax year. Because of these IRS regulations, the DCFSA election you make during open enrollment may be subject to reduction pending the results of mandatory non-discrimination testing performed by a third-party vendor. If, after this testing is completed, it is determined that 1) you are highly compensated, and 2) your DCFSA contribution must be reduced, then you will be notified of such reduction. In addition, any reimbursements that exceed the adjusted maximum DCFSA contribution will be reported as taxable income to you on your IRS Form W-2 for the 2026 tax year.”

2. NO ACTION IS REQUIRED to continue your coverage in the following plans:

- Medical, dental, vision, life, disability, and/or identity protection coverage(s) will continue.

- If you are currently enrolled in these benefits and do not plan to make any changes, then you do not have to take action in Benefitfocus. You will keep your current benefits and these coverage(s) will roll over as-is beginning Jan. 1, 2026.

3. REVIEW YOUR BENEFICIARIES for life, disability and retirement:

Beneficiary information is required in Benefitfocus for your life and AD&D plans and it’s recommended to review this information annually. You can follow the steps to enroll below to login to Benefitfocus, then click the ‘Manage Your Beneficiaries‘ button on your Benefitplace dashboard.

You should also annually review beneficiary information for your retirement plans, and you can manage this with each specific carrier – Teachers’ Retirement System (TRS) for the mandatory 401(a), and/or TIAA for optional 403(b) and/or 457(b) plans.

Update Your Beneficiary with TRS

Notarized Form Is RequiredComplete the Designation of Beneficiary Form – Prior to Retirement, notarize and return form directly to TRS at PO Box 302150, Montgomery, Alabama 36130-2150.

Update Your Beneficiary with TIAA

Access Your Online DashboardLogin to your TIAA dashboard from the Employee page in myBama, then select ‘Profile’ and ‘Manage Beneficiaries‘ to review and update.

Campus-Wide Information Sessions

| Date | Time | Location |

|---|---|---|

| Thur., Sept. 25, 2025 | 1:00 – 2:00 pm | In-Person* or Virtual |

| Thur., Oct. 2, 2025 | 3:30 – 4:30 pm | In-Person* or Virtual |

| Fri., Oct. 10, 2025 | 11:00 am – 12:00 pm | In-Person* or Virtual |

| Wed., Oct. 22, 2025 | 12:00 – 1:00 pm | In-Person* or Virtual |

Communications

- What’s New? Open Enrollment Flyer

- Postcards (Campus Box & Home)

- Digital Signage Designs

- Information Session Slides

Need extra help? Benefits Office staff will be available on-site at three events in October to assist employees who need help enrolling in Benefitfocus. iPads will be available. Come see us for one-on-one guidance!

How to Enroll in Benefitfocus

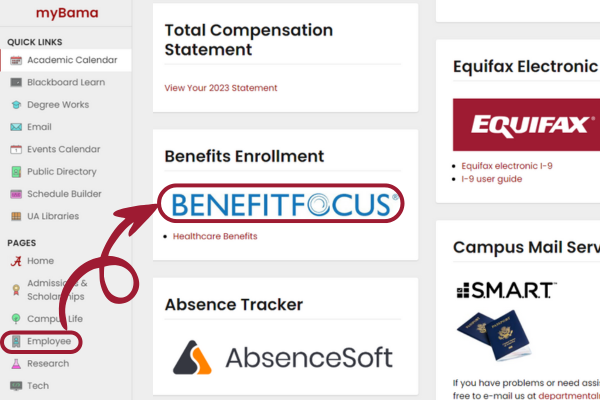

Benefitfocus is available via single sign-on from the Employee page in myBama. Follow the step-by-step instructions below to enroll online.

Your Benefitfocus online dashboard is available 24/7/365. Any changes made to benefits during Open Enrollment will be effective Jan. 1, 2026.

Login to myBama

Navigate to your Employee page

Click Benefitfocus logo for single sign-on

Click the Open Enrollment button

Select Get Started link to see plan options

Complete and save your benefits enrollment!

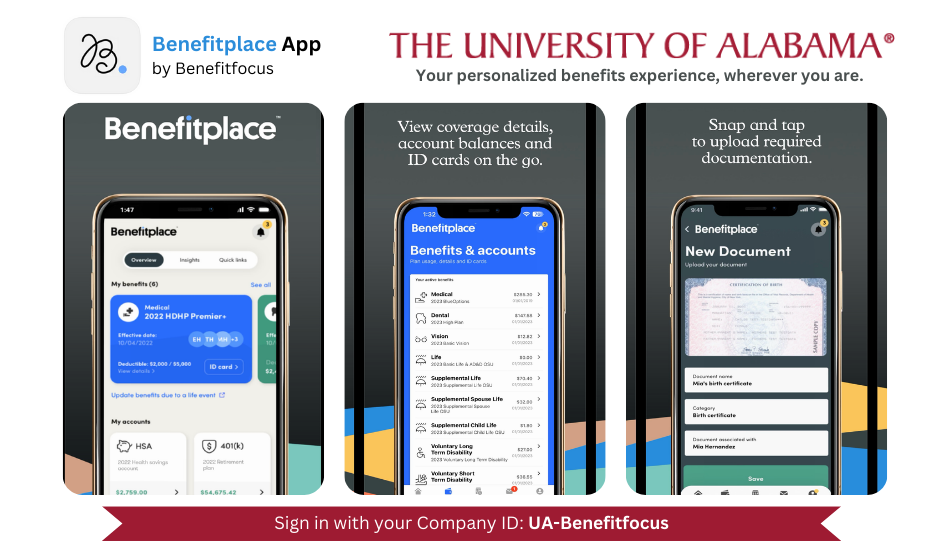

check markBenefitplace Mobile App

We’ve simplified the enrollment process with mobile access! Employees may also use single sign-on with the Benefitplace mobile app. Download the app, enter Company ID: UA-Benefitfocus, and login with your myBama username and password plus required Duo two-factor authentication. View the mobile app guide for step-by-step instructions to get started.

New! Pop-Up Enrollment Events

Staff from the Benefits Office will be available on-site at three wellness events during Open Enrollment (Oct. 15 – Oct. 31) to assist employees who need help enrolling in Benefitfocus. iPads will be available. Come see us at the following events for one-on-one guidance!

Health Plan Changes

UA employees will continue to have a choice in medical plans between the Preferred Provider Organization (PPO) plan or the High Deductible Health Plan (HDHP) option!

While the PPO plan maintains the largest member enrollment with the highest claims spending trend, the HDHP continues to be an increasingly popular choice – approximately 27% of eligible employees who enrolled in medical insurance this year selected the HDHP. Covered services, provider network, and pharmacy formulary are the same between the two plans, so it’s important to carefully weigh the cost trade-offs to determine which plan is best for you. Key plan differences include:

| HDHP with HSA | PPO | |

|---|---|---|

| Premium: | Lower per paycheck | Higher per paycheck |

| First-Dollar Deductible: | Higher each year | Lower each year |

| Member Cost Share: | Coinsurance (20%) | Fixed, flat-dollar copayments |

| Out-of-Pocket Maximum: | Lower per year | Higher per year |

| Tax-Favored Account: | Health Savings Account | Healthcare FSA |

Q1. What is my member cost share?

A. Your member cost share equals the share of total costs covered by insurance that you pay out of your own pocket. This is separate from your premium, and includes: 1) your first-dollar deductible, where you pay 100% of the cost up to a certain amount before UA's plan starts covering costs; 2) your copayments, a fixed flat-dollar fee you pay per service; and/or coinsurance, a set percentage of the cost you're responsible for paying out-of-pocket. Copayments and coinsurance only apply after your first-dollar deductible is met. Your cost share has an annual out-of-pocket limit.

Q2. What is my out-of-pocket maximum?

A. Your out-of-pocket maximum is a cap, or limit, on the total amount of money you have to pay out-of-pocket for covered health care services in a calendar year. If you meet that limit, UA will pay 100% of your covered health care costs for the remainder of the year. Your out-of-pocket maximum includes your deductible, plus any copayments or coinsurance you paid; premium deductions on your paycheck are not included in this total.

The following plan design changes will be effective Jan. 1, 2026:

PPO Member Cost Share

The first-dollar deductible will increase from $500 to $600 per person per year. You are responsible for paying 100% of the cost per service until you meet this deductible each year, then UA’s plan will kick in.

Don’t forget your first-dollar deductible resets each January! You may experience higher upfront costs for a doctor’s office visit or a prescription refill initially until you meet your first-dollar deductible.

Most preventative care, like well checks and screenings for certain diseases, are free and fully covered regardless of deductible. View a comprehensive list of preventive services.

PPO Copayments

Copayments will increase to the following:

- Outpatient Surgery: $300

- Inpatient Admission: $600

- Emergency Room Visit: $300

- Specialist Office Visit: $65

These services are commonly targeted due to higher claims costs for more complex care and higher utilization by plan members.

Site of care matters! It’s important to decide where you receive your medical care because it may significantly affect your costs and convenience. For example, using 24/7 telemedicine for an acute illness is significantly cheaper than an ER visit.

HDHP Member Cost Share

The first-dollar deductible will remain the same: $1,700 for employee only, and $3,400 for family plans. These are the minimum deductible allowed per IRS regulations.

The annual out-of-pocket maximum for in-network services will remain the same: $4,500 for employee only, and $9,500 for family plans.

The once-per-year employer contribution (seed money) will remain the same at $500 for employee only and $1,000 for family tiers. This employer seed money is factored into the overall HSA contribution limits set by the IRS each year.

Pharmacy Changes

Increased Copayments: In 2024, UA paid 38% of total claims costs for pharmacy expenses, and recent employer surveys anticipate an 11-12% increase in these pharmacy costs in 2025 into 2026. As a result, copayments for PPO plan members will increase for all drug tiers next year. Copayments do not apply to the HDHP medical plan which will continue to have a 20% coinsurance after deductible. Approximately 85% of prescriptions filled by UA employees and covered dependent(s) are for generic drugs, with brand and specialty drugs driving pharmacy costs.

| Prescription Drug Tier | 2025 PPO Copayment* | 2026 PPO Copayment* |

|---|---|---|

| Tier 1 – Generic | $15 | $20 |

| Tier 2 – Preferred Brand | $55 | $65 |

| Tier 3 – Non-Preferred Brand | $75 | $85 |

| Tier 4 – Specialty | $150 | 20% coinsurance, up to $250 max |

- Did you know? Mail-order/home delivery services are available with a discounted copay for 90-day supplies of certain maintenance medications. Learn more about Prime Therapeutics’ Home Delivery Network with Amazon Pharmacy.

- What prescriptions are covered? Review the NetResults 1.0 prescription drug list for Large Group Plans on the Blue Cross and Blue Shield website. Select the 4 tiers – standard option.

InfoFormulary Changes and Limitations

A formulary is a list of prescription medications that are covered by your health insurance plan. It’s common for all pharmacy benefit managers, including Prime Therapeutics, to make formulary changes during a year. New medications, safety concerns, cost-effectiveness, and the introduction of generic or biosimilar equivalents are frequent reasons for these updates and all final decisions are made by the PBM.

Prime Therapeutics adjusts all prescription drug lists four (4) times per year, with more significant changes typically effective Jan. 1 and July 1 each year. No formulary will cover all available prescription drugs, so the clinical appeals process is available for members with specific needs.

Employee Premiums

For many years, UA employees benefited from flat medical premiums. The PPO rates were unchanged from 2021 – 2024, while the HDHP rates remained unchanged from 2020 – 2024. In comparison, large employers nationwide routinely increased premiums each year to offset the rising costs of medical and pharmacy inflation. For 2026, employers will face mounting financial pressure with recent surveys indicating the total health benefit cost per employee is expected to rise 6.5% on average — the highest increase in 15 years — even with planned cost-reduction measures.

In addition to plan design changes, UA will increase employee and employer premiums for the PPO and HDHP medical plans. Detailed rate comparison charts are included in expandable menus below.

- Employee Only: +$12 per month increase

- Family without Spouse (Employee + Child(ren)): +$42 per month increase

- Family with Spouse (and/or Child(ren)): +$50 per month increase

Medical & Dental Rates for Non-Exempt Staff

The following rates are for non-exempt, bi-weekly paid staff employees only. The premiums are collected over 24 paychecks per year, the 1st and 2nd bi-weekly pay period each month.

| PPO Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $60.50 | $66.50 |

| Family without Spouse | $211.00 | $232.00 |

| Family with Spouse | $248.50 | $273.50 |

| HDHP Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $31.00 | $37.00 |

| Family without Spouse | $107.00 | $128.00 |

| Family with Spouse | $126.50 | $151.50 |

| Dental Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $14.19 | $14.90 |

| Employee + One | $27.80 | $29.19 |

| Full Family | $40.29 | $42.30 |

Medical & Dental Rates for Exempt Staff, 9-over-12 Faculty and 12-month Faculty

The following rates are for professional exempt staff, 9-over-12 faculty with salary deferral, and 12-month administrative faculty. The premiums are collected over 12 paychecks per year.

| PPO Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $121.00 | $133.00 |

| Family without Spouse | $422.00 | $464.00 |

| Family with Spouse | $497.00 | $547.00 |

| HDHP Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $62.00 | $74.00 |

| Family without Spouse | $214.00 | $256.00 |

| Family with Spouse | $253.00 | $303.00 |

| Dental Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $28.38 | $29.80 |

| Employee + One | $55.60 | $58.38 |

| Full Family | $80.58 | $84.60 |

Medical & Dental Rates for 9-over-9 Faculty (based on Pay Distribution Cycle election)

The following rates only apply to faculty who chose the non-deferred pay distribution cycle. These rates are accelerated in comparison to the 12-month premiums for exempt staff and other faculty, and only collected on 9 monthly paychecks – September thru May each year.

| PPO Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $161.33 | $177.33 |

| Family without Spouse | $562.67 | $618.67 |

| Family with Spouse | $662.67 | $729.33 |

| HDHP Medical Plan Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $82.67 | $98.67 |

| Family without Spouse | $285.33 | $341.33 |

| Family with Spouse | $337.33 | $404.00 |

| Dental Tier | 2025 Rate | 2026 Rate |

|---|---|---|

| Employee Only | $37.84 | $39.73 |

| Employee + One | $74.13 | $77.84 |

| Full Family | $107.44 | $112.80 |

InfoNew rates for medical and dental only

Vision rates for UA’s fully-insured vision plan with VSP will remain unchanged for plan year 2026.

Vision Benefits

All employees enrolled in UA's vision insurance transitioned to Vision Service Plan (VSP) last year. Your plan now features lower premiums with a 4-year rate guarantee, a higher $180 allowance for frames or contacts, new services including KidsCare and expanded maternity benefits, as well as exclusive member extras!

No physical ID card is necessary to use your vision plan, and you can browse the VSP provider network to make an appointment. VSP enables a ‘connected claims’ feature to better assist you with substantiation of qualified FSA expenses.

Doctor on Demand

Doctor On Demand by Included Health is an independent company that provides a telehealth mobile app and health services on behalf of Blue Cross and Blue Shield of Alabama. Doctor On Demand replaced Teladoc services this year, and will continue to serve as the dedicated telemedicine company for UA employees in 2026.

In addition to general medicine/urgent care services like those offered by Teladoc, Doctor on Demand will also provide behavioral health and dermatology services. All employees and covered dependent(s) enrolled in UA’s PPO or HDHP medical insurance plan will have access to Doctor on Demand. Fees vary based on visit.

EAP

ComPsych GuidanceResources is your complimentary Employee Assistance Program (EAP). Connect to live services for behavioral care, including phone calls, videos, and digital self-care tools. You and your family can receive up to five (5) free counseling sessions per issue per year! Call 1-888-283-3515 to get started.

The GuidanceResources online dashboard and GuidanceNow mobile app also provide comprehensive resources for your emotional, work-life, legal, financial, physical health and more! You can even assess your well-being to receive personalized plans based on your unique profile and needs.

Find Additional Savings

Don't forget! Your Bama Perks employee discount program provides exclusive discounts and opportunities to save with local and national businesses. Bama Perks vendors will require your Action Card to redeem the discount, or may ask you to enter a discount code on their website. Take advantage of additional savings each month to help offset premium increases!